Note: Join our B2B Community here if you like this post.

Company growth is the most common starting point in discussions with CEOs and founders, and it is the right starting point, but the equation goes something like this: if I want to expand my business, I need to find new customers and help with sales and marketing.

It is the only way to grow your business. Is it? Are we not instead having a mental short-circuit that creates blind spots and prevents the study of different approaches and solutions?

We need to look at how a cash cycle works to answer that question. The framework provides a method to measure:

- “how long” the cash is tied up in the business cycle

- “how much” profit and cash are generated in each cycle

- “how fast” a business can grow by reinvesting the money generated in each cycle thanks to that profit, i.e., without additional external cash from the founder or the investors.

What are the implications for a CEO or a Founder?

This framework highlights the levers to improve the company’s cash position, with clear implications for CEOs and Founders.

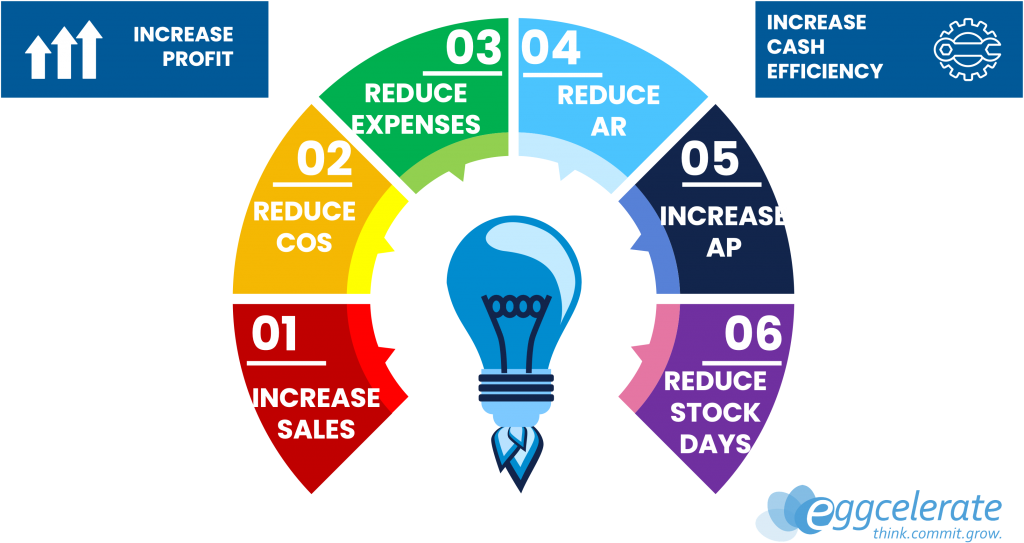

Efficient increases in turnover increase the profit available to reinvest into the business. You could achieve this by addressing new and existing customers, introducing new products and raising prices as much as possible; and, of course, by reducing costs, negotiating better prices with your suppliers and optimising your operating costs (points 01, 02, 03 in the image).

At this point, most people will stop right here, right now, and do nothing else for too long. Let’s turn our attention to points 04, 05 and 06 in the same image. A business could increase the number of operating cash cycles per year by adjusting payment terms to customers and suppliers and managing the inventory.

In other words, to increase profits, you need to improve cash efficiency to gain an advantage.

Where to start.

We recognise that it is not easy to improve cash efficiency by reducing customer payment terms. Companies should try first and foremost to spend better, rather than less.

You can work on your inventory and supplier base. You can negotiate better terms, prices and payment terms with your suppliers. For some products, you can buy in larger quantities. For those who have recurring purchases, you can shop in smaller amounts but more frequently.

To improve your business, look beyond the obvious leverage you can get. On the one hand, if you can improve margins, more money is available for investment in each cycle. On the other hand, you can keep your suppliers in fair competition without ruining relationships, reducing inventories and increasing the number of cycles.

Please read the full article on London Business Matter, or watch the webinar on We Are Umi.

Join our B2B Community here if you liked this post.